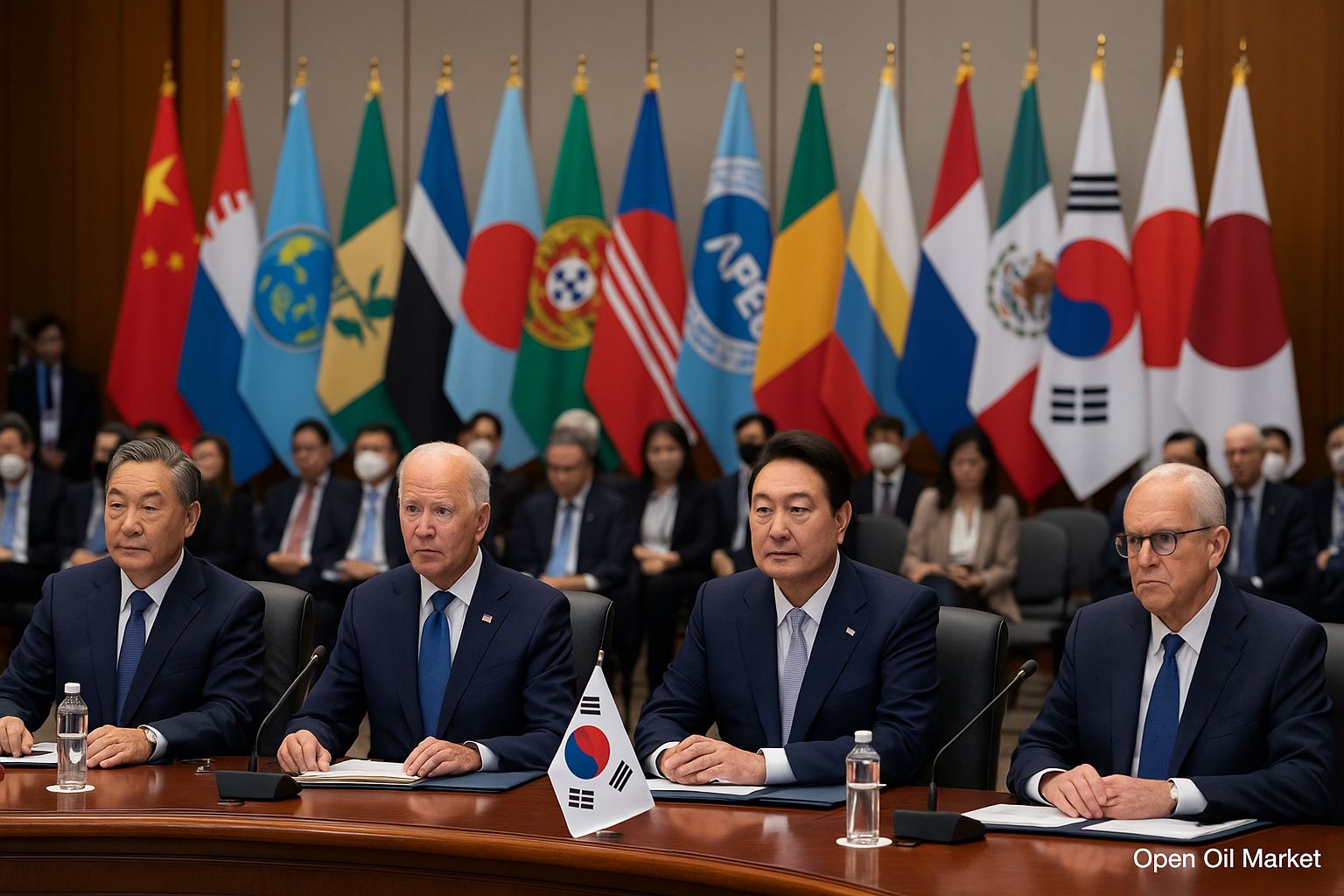

Analysis of Key Economic Events and Corporate Reports for Saturday, 1 November 2025. APEC Summit in South Korea, Earnings Releases from S&P 500, Euro Stoxx 50, Nikkei 225, and MOEX. Recommendations for Investors.

Saturday, 1 November sets an intriguing backdrop for investors: the second day of the APEC summit in South Korea is underway, where leaders are discussing key trade and regional development issues, while markets prepare for a series of quarterly earnings reports from major companies. The focus is on the economic agenda of Asia and the USA, alongside corporate performance in the USA, Europe, Asia, and Russia. Investors should closely observe the outcomes of negotiations at the APEC summit and the subsequent earnings releases over the weekend, which will shape risk perception and interest rate expectations.

APEC Summit 2025 — Day 2

On the second day of the APEC (Asia-Pacific Economic Cooperation) summit in Korea, discussions continue to centre around trade and economic cooperation, investment, and energy security. Leaders are addressing:

- the dismantling of trade barriers: advancing negotiations between the USA and China at the summit and promoting bilateral agreements on logistics and key resources;

- climate and sustainable development: aligning new commitments to reduce carbon footprints and support for the region's green economy;

- innovative technologies: initiatives for digitisation and cybersecurity, including the expansion of projects in AI and fintech;

- APEC expansion: deliberations on the integration of new members (such as East Timor) and enhancing regional security through joint economic projects.

Against this backdrop, Asian markets are cautiously responding to signals regarding the extension of economic activity, as well as geopolitical news. Any signs of success in trade negotiations may bolster risk appetite and increase Asian indices, while heightened disagreements could drive investors towards safe-haven assets (the yen and gold).

Macroeconomic Background

The Russian market is on a break: 4 November is the Unity Day, making the next trading day Monday. The Central Bank of the Russian Federation has set the official dollar exchange rate for Saturday, 1 November at approximately 80.98 rubles, slightly higher than the previous day’s rate. The oil market is showing moderate price declines: Brent is trading around $64-65/barrel, losing ground due to a strong dollar and surplus supply. Investor attention in the early part of the week will shift to global PMI releases and other statistics: revisions to manufacturing PMI indices for the USA, eurozone, and China are expected by the weekend, setting the tone for expectations regarding central bank interest rates. The state of global inflation and consumer price dynamics in major economies remain key drivers for currency and bond rates.

Corporate Reports from the USA and Asia

- Grab (NASDAQ: GRAB, Singapore/USA): 3rd quarter 2025 results are expected to be released after the market closes on 3 November, followed by a conference call with management.

- Goodyear (NYSE: GT, USA): will publish its 3rd quarter report after market close on 3 November; presentation and comments will take place the following day.

- Ichor Holdings (NASDAQ: ICHR, USA): will release its financial results for the 3rd quarter immediately after market close on 3 November, followed by a call for investors.

- Advanced Micro Devices (NASDAQ: AMD, USA): will issue its report for the 3rd quarter after market close on 4 November – investors will be focused on data concerning the semiconductor business.

- Amgen (NASDAQ: AMGN, USA): will release its 3rd quarter results after market close on 4 November, with market attention on the sales figures of new pharmaceuticals.

- Chinese and Asian issuers: while major Asian markets are closed on Saturday, attention remains on recent events in the region – for instance, IPOs and reports from major Chinese companies (tech giants, banks) that will be released shortly after holidays in mainland China.

Corporate Reports from Europe

- Ryanair (Dublin/Frankfurt): the report for September 2025 will be released before market open on 3 November – attention will be on passenger traffic and futures prices for fuel.

- Associated British Foods (LSE: ABF, UK): will publish its report before trading begins on 4 November; analysts expect moderate revenue growth driven by a diversified portfolio (food, retail).

- BP (LSE: BP, UK): will report before trading starts on 4 November; investors are awaiting commentary on oil production and gas projects amid price volatility.

- Ferrari (NYSE/MTA: RACE, Italy/USA): the report for the 3rd quarter will be released after market close on 4 November; key metrics include sales performance of luxury vehicles and development of new models.

- Pfizer (NYSE: PFE, USA): will report after market close on 4 November; the market is eager for updates on vaccine and medicine sales in the third quarter.

- Uber (NYSE: UBER, USA): earnings report after market close on 4 November – investors are interested in the dynamics of delivery and taxi services.

- Toyota Motor (TSE: 7203, Japan): will publish its financial report on 5 November before market open – key metrics include revenue from vehicle sales and costs related to electrification.

- McDonald’s (NYSE: MCD, USA): will present its results on 5 November before trading begins; markets will pay attention to margins and sales of coffee and burgers.

- Pandora (OMX: PNDORA, Denmark): will report after market close on 5 November; investors are watching demand for jewellery and consumer behaviour.

Corporate Reports from Russia and the CIS

- MOEX Group (MOEX): is scheduled to disclose trading volumes for October 2025 on 1 November. These figures will indicate investor activity on the Moscow Exchange following the October reports from major banks and commodity firms.

- Major Banks and Corporations in Russia: Sberbank (typically publishes a summary for 9 months), Gazprom Neft, Norilsk Nickel, Rosneft, and others – presented their results for 9 months at the end of October. Investors will compare their metrics against expectations for central bank rates and the dynamics of the ruble.

- Dividends and Corporate Decisions: 1 November is the deadline for dividend payments by certain Russian issuers (such as EuroTrans, MD Medical). Attention should be directed to corporate news in the following week ahead of the IFRS reporting season in Russia.

What Investors Should Note

Investors must relate the geopolitical backdrop to corporate dynamics. First and foremost, keeping an eye on the outcomes of the APEC summit is crucial: progress in trade negotiations between the USA and China or new climate initiatives could shift global sentiment. Secondly, key reports from major companies within the S&P 500, Euro Stoxx 50, Nikkei 225, and MOEX will set the tone for market forecasts in Q4. Additionally, evaluating market reactions to energy trends is essential: sharp fluctuations in oil prices or changes in OPEC+ policy influence the stocks and currencies of emerging markets. Among macroeconomic indicators, global PMIs and industrial statistics will be in focus early in the week – strong figures could fuel expectations for tighter monetary policy. Conservative investors might hedge risks through currency assets and gold, while risk-takers should diversify their portfolios considering potential volatility following a news-rich week.